ABOUT

TOWER REIT

Tower REIT is a real estate investment trust that was established to invest in prime office and commercial real estate assets, with the aim of generating stable and regular distributions to Unitholders while growing the Trust’s net asset value (NAV) per Unit.

The Trust was established in 2006, constituted under the Deed dated 17 February 2006, entered into between GLM REIT Management Sdn Bhd as the Manager, and MTrustee Berhad as the Trustee of Tower REIT. Following a successful initial public offering, Tower REIT was listed on the Main Market of Bursa Malaysia Securities Berhad on 12 April 2006.

In 2007, Tower REIT diversified its portfolio objectives to allow for investments in residential and industrial real estate. This was aimed at allowing the Trust to capitalise on broader market opportunities and to enhance its growth prospects. The Trust’s overarching investment objectives remained unchanged – namely, to invest primarily in a portfolio of high-quality real estate, including office buildings, commercial, residential and industrial properties, in order to:

- provide Unitholders with regular and stable distributions; and

- achieve medium to long-term growth in its NAV per Unit.

Today, the Trust boasts a portfolio of three Grade A, premium office buildings, valued at over RM800 million. The properties are strategically located in prime locations and feature excellent amenities and ancillary facilities that have attracted a stellar tenant base, ranging from multi-national corporations to up-and-coming start-ups.

3

No. of Assets

RM806,000,000

Total Portfolio Value

966,613 sq. ft.

Total NLA

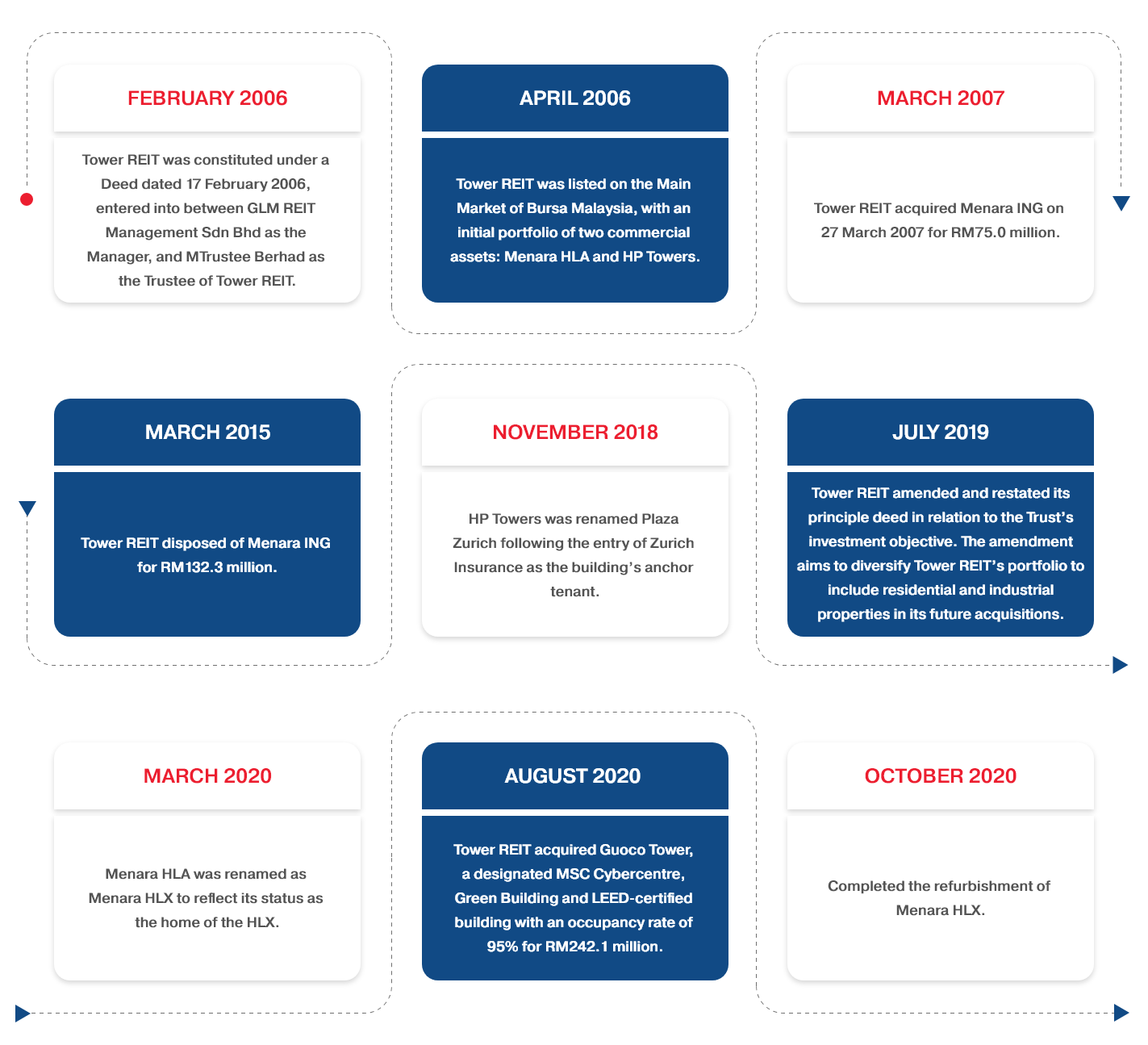

KEY MILESTONES

Strategic Direction

Tower REIT’s objective is to invest in quality office, commercial, residential and industrial real estate to generate regular and stable distributions to Unitholders, and to achieve medium to long-term growth in its NAV per Unit.

Our approach towards achieving this is centered on four strategic focus areas:

Identifying and securing strategic acquisition targets that can offer sustainable income streams and capital appreciation potential, and that would complement the Trust’s overall portfolio strategy

Optimising the utilisation of space within the portfolio to maximise the long-term returns on all real estate assets

Ensuring the relevance and appeal of the portfolio by repositioning and aligning the assets to meet the trends and needs of the market, tenants and consumers

Reviewing the portfolio to identify assets for potential divestment consideration

Seeking portfolio optimisation opportunities from external parties as well as from within the Hong Leong Group

Providing premium office space solutions and superior service levels that exceed tenants’ evolving business needs and expectations

Implementing asset enhancement initiatives to ensure the portfolio’s relevance and to enhance sustainability

Embracing technology and introducing tech-enabled solutions to improve portfolio and tenant management functions

Executing proactive leasing and marketing strategies

Optimising occupancy levels, extending the weighted average lease expiry (WALE), as well as managing the portfolio’s lease expiry profile to ensure a resilient and stable income stream

Extracting operating efficiencies and cost savings through efficient supply chain management

Optimising the capital structure to ensure sufficient liquidity and to maximise returns to Unitholders

Managing the debt maturity profile to reduce refinancing risks

Exploring alternative funding sources in debt and equity markets to minimise financing costs

Limiting exposure to fluctuations in interest rates

Nurturing, motivating and retaining a capable and passionate team to drive growth, innovation and operational excellence

Investing in training and development programmes to raise employees’ competency levels and skillsets

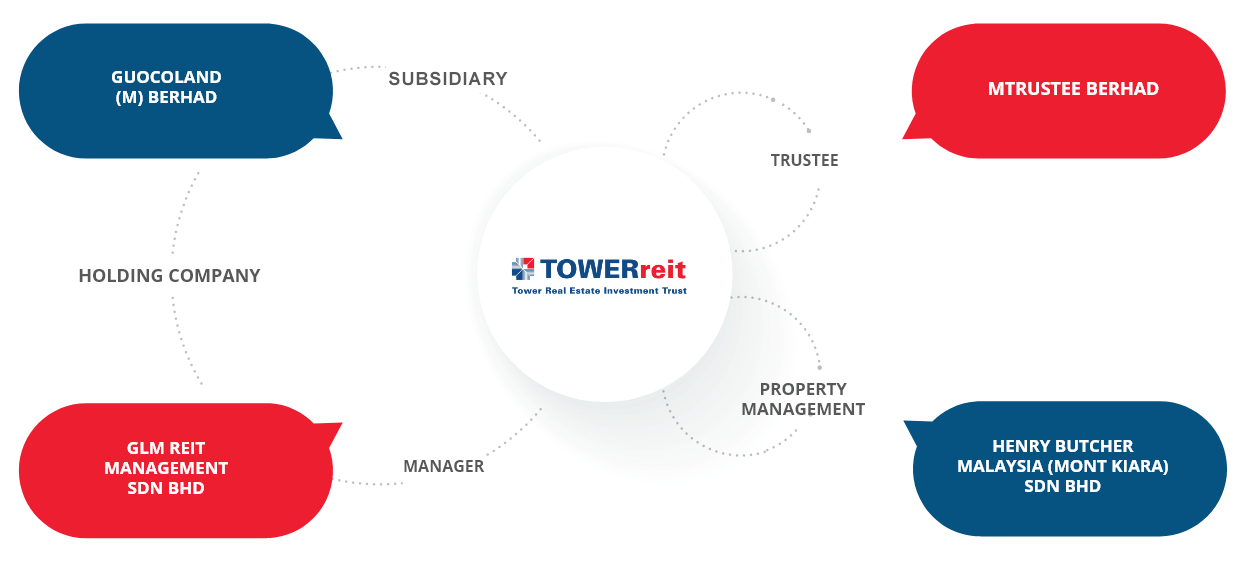

Trust Structure